Competencies

Targeted Business Models

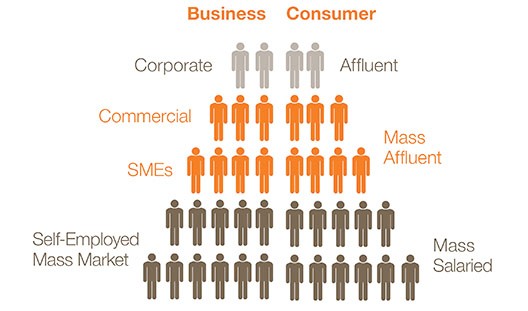

Our extensive experience in managing financial institutions across the region with a focus on serving Mass Market consumers, microentrepreneurs and SMEs is the cornerstone of our core competency.

We have built and refined customer-centric business models that help us to understand, anticipate and satisfy the needs of our customers in a sustainable and value-enhancing way.

- Focus on Underserved Mass Market Segments

- Customised Products and Solutions

- Excellence in Operational Execution

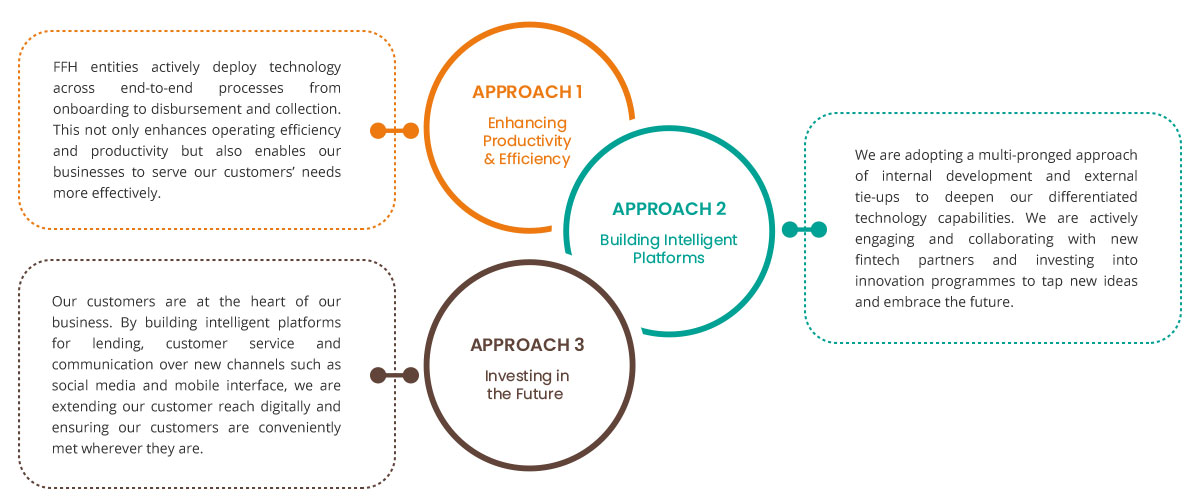

Technological & Digital Innovation

We lead our portfolio companies in digital innovation, weaving technology into all aspects of the way we do business, and seek more effective ways to reach underserved customers.

FFH Digital Approach

Risk Management

Robust corporate governance and a culture of vigilance are deeply embedded into each of our entities’ DNA and serve as the core foundations for enduring success.

Best-in-class Corporate Governance

We bring a best-in-class corporate governance framework that aims to safeguard the interests of all stakeholders at each of our entities, oftentimes in less mature and transparent markets.

Strong Risk Culture

A strong risk culture ensures that everyone does what is right and there is clear accountability and ownership of specific risk areas within all FFH entities.

Robust Risk Architecture

The three lines of defense – front line, compliance/assurance and internal audit – are strongly embedded in each entity to minimise operational losses.

Comprehensive Risk Standards

To manage risks, all FFH entities are guided by comprehensive risk standards - Governance, Risk Management and Control (GRMC) standards – which sets out global best practices.

Common Framework

To manage risks, all FFH entities are guided by comprehensive risk standards - Governance, Risk Management and Control (GRMC) standards – which sets out global best practices.

Brand & Network

Our brand is built on strong foundations and recognized in the financial services across emerging Asia for our credibility, strength in governance and best-in-class practices.

Behind the Logo

Our logo was developed with an influence on ‘steps’, with upward moving steps representing progression and prosperity. These ‘steps for success’ signify how we help our business grow and enabling our people with ‘a step up’, in our vision to bring sustained growth in our portfolio, and mission in enabling success and enriching lives.

Our Network & Partnerships – Centre of Excellence

Local Partnerships

Through the organic and inorganic growth of the FFH franchise, the local partners in the emerging markets we choose to operate in are vital to the success of our business.

Synergistic Partnerships

With our existing portfolio of companies, we look to build new partnerships that are complimentary and able to integrate into our business.

International Partnerships

With our presence in Asia-focused emerging markets, partners with an international sphere of reach is advantageous to our existing group of portfolio companies, and any potential new businesses.

Human Capital

Our competitive advantage stems from the key competencies our diverse pool of seasoned professionals bring, and our ability to effectively deploy them in the FFH ecosystem.