Targeted Business Models

![]()

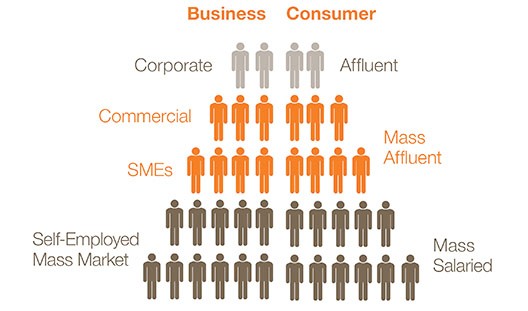

Our extensive experience in managing financial institutions across the region with a focus on serving Mass Market consumers, microentrepreneurs and SMEs is the cornerstone of our core competency. We have built and refined customer-centric business models that help us to understand, anticipate and satisfy the needs of our customers in a sustainable and value-enhancing way.

Focus on Underserved Mass Market Segments and SMEs

Despite macroeconomic weakness and industry challenges, Emerging Asia broadly remains on a longterm secular growth track that will bring vast new wealth in these markets. FFH’s mission is to ensure this growth is balanced and shared across the customer landscape, with a specialisation in providing financial access to the underserved and SME segments. We have built and managed businesses with a Mass Market niche in Indonesia, Malaysia, India, China, Cambodia, Myanmar, UAE and Pakistan. This has allowed us to understand that each market is unique and requires business models that are tailored to meet and serve the eclectic needs of local customers.

Customised Products and Solutions

We ensure that our portfolio companies meet the distinctive needs of our different customer segments through bespoke product design, including appropriate price, tenor, amount, and collateral requirements. At Fullerton India, the loans offered to the Group Lending customers – typically groups of women in rural areas with financing needs for livelihood purposes – will generally be smaller in ticket size and shorter in tenor, compared to loans offered to urban consumers. We adopt systematic in-market tests using a “test and learn” approach on products and refine them accordingly to meet the changing demands of customers. To enable successful delivery of our value proposition and smooth customer engagement, our entities adopt distribution models and technologies that bring us closer to customers.

Excellence in Operational Execution

Specialised business models require consistent execution excellence to be successful. We establish and abide by a blueprint of end-to-end processes for every business activity while also adopting a continuous process improvement philosophy, recognising that no environment remains static. This allows our entities to deliver high quality service to our customers and rigorously manage operational risks across the various types of catchment models employed. In addition, FFH helps to instill a culture of disciplined execution across our organisations underpinned by robust systems, vigilant oversight and strict accountability